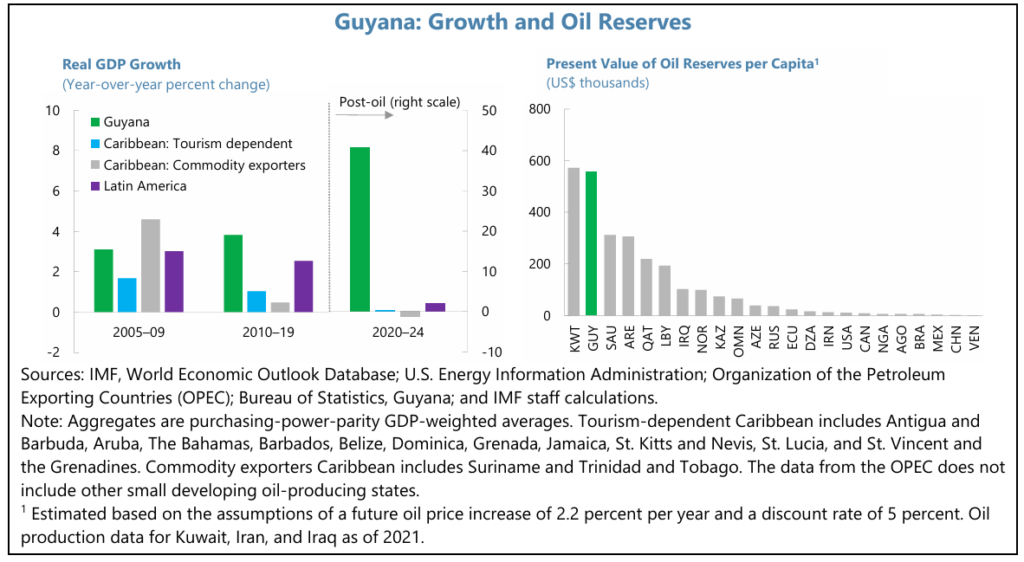

Guyana is rapidly emerging as one of the most dynamic economies in the world, with an incredible economic growth streak averaging 47% per year since 2022, the International Monetary Fund (IMF) reported in May.

In its latest Article IV Consultation report, the IMF Executive Board projected GDP growth averaging 14% annually for Guyana over the next five years. The report indicated that its economy is growing rapidly, getting stronger, and broadening in scale. The true significance of the findings in the IMF report might lie in how Guyana’s remarkable economic ascent challenges conventional assumptions about emerging investable markets.

The IMF projects that the GDP growth will outpace many larger economies, based on oil expansion, infrastructure investment, and strategic fiscal discipline. Traditional investment strategies lean toward large, densely populated economies as the most viable emerging markets.

Yet, the compelling picture of the thriving economy might challenge conventional wisdom about what attracts global investors; this may alter their impression of what constitutes a high-potential market.

Key IMF Findings

Key findings in the IMF report underscore critical trends distinguishing Guyana from traditional emerging market narratives, like figures showing explosive yet balanced economic growth. Guyana posted the highest real GDP growth rate worldwide since 2022, 47% annually on average. Oil GDP surged 58% in 2024, but non-oil sectors expanded by 13%, showing growth that is not solely dependent on petroleum. Also, infrastructure projects have broadened the economic base, increasing the possibility of sustainability beyond oil revenues.

The report noted that inflation increased from 2% at the end of 2023 to 2.9% by year-end 2024, largely because of higher international food prices and local supplies affected by floods. Also, the fiscal deficit increased to 7.3% of GDP (21% of non-oil GDP) in 2024, up from 5.1% of GDP (11.7% of non-oil GDP) in 2022, mainly due to a substantial increase in capital expenditure. The IMF predicts that inflation will increase to around 4% in 2025, and the fiscal deficit and current account surplus will narrow in 2025.

However, the current account surplus more than doubled in 2024, driven by higher oil exports, reaching about 24.5% of the GDP. By the end of 2024, gross international reserves surpassed USD1 billion, while the Natural Resource Fund (NRF) accumulated over USD1.1 billion in 2024, reaching USD3.1 billion (over 12.5% of GDP). The IMF estimates that the continued expansion of oil production will further strengthen the external position in the medium term, with substantial savings accumulation in the NRF.

In particular, the report highlighted fiscal prudence and long-term stability. According to the IMF, Guyana is strategically accumulating savings, unlike many resource-rich economies that overspend during booms. The NRF grew to USD3.1 billion in 2024, creating a buffer against future volatility. Policymakers have committed to eliminating fiscal deficits over the medium term, reinforcing macroeconomic stability.

Investor Confidence

With the IMF projecting a robust economy for the next five years, Guyana is in an excellent position to optimize investor confidence and achieve a strong external position (or net creditor position) with more foreign assets than foreign liabilities. The current account surplus doubled to 24.5% of GDP in 2024, and gross international reserves surpassed USD1 billion, strengthening financial resilience.

The IMF commended Guyana for its business-friendly environment, noting advancements in governance, financial oversight, and transparency. This positive review highlights its strong potential as a prime investment destination.

Why Guyana Stands Out

Historically, population size, industrial diversification, and geopolitical influence have shaped perceptions of economic potential. Guyana’s economic boom challenges these assumptions by proving that a small nation can generate huge returns.

Emerging markets typically attract investors based on scale—large populations promise expansive consumer bases and labor markets. Guyana flips this model on its head because high-income status is within reach of its small population of under 900,000 people, showing that strong fiscal management and strategic sectoral growth can be more valuable than sheer scale. The oil sector is not just generating wealth; it fuels infrastructure improvements that create investment opportunities in other sectors, such as construction, energy, and financial services.

The IMF report indicates economic resilience that reduces the risk of a boom-bust fallout. Commodity-driven economies often struggle with volatility, where price fluctuations wreak havoc on long-term stability. Guyana is breaking this pattern. While oil is the key revenue driver, non-oil GDP is expanding at an impressive rate, ensuring sectoral diversification. Also, the IMF report did not flag aggressive spending as an impediment to economic advancement, which will reinforce investor confidence.

If the IMF predictions hold, Guyana is poised to be a new model for emerging market investment, representing a shift in investor priorities. It would demonstrate that economic vision and governance quality can be as significant in shaping investment decisions as large size and traditional growth metrics.

The positive IMF assessment of fiscal policy, governance, and financial oversight boosts Guyana’s potential as a model for sustainable investment environments. The report points to a business environment that will create opportunities beyond oil and gas—like infrastructure development, logistics, and financial services, making Guyana a well-rounded market for investors.

The Future

Guyana’ s exceptional economic performance, validated by the IMF’s detailed assessment, presents a compelling case study in resource driven development. The country has successfully navigated the early stages of its petroleum boom while maintaining macroeconomic stability and developing non-oil sectors.

The IMF paints a picture of a unique combination of robust growth, improving governance, and strategic investment in future capabilities. If this developing nation wisely utilizes oil and gas revenues for economic growth, it can rewrite the blueprint for attracting global investment to attain sustainable prosperity.